Why Is Multifamily Real Estate Investing Better Than Single-family?

Why is multifamily real estate investing better than single-family? Well, that is one of the most frequent questions that lingers on an investor’s mind and this article answers the very same question.

Right now, in the multifamily real estate market, there are some significant trends happening that we have never seen before.

With the Covid-19 led economic slowdown, an unprecedented number of people are preferring to rent homes than having their own. The rental market is indeed getting vibrant. Millennials prefer to rent as they don’t want to be locked down with mortgage repayment as well as a particular location, given the jobs environment. They like to be mobile. So they are not buying and that’s a huge shift in the thought process.

With this rising trend in the U.S. potential investors not only from within the country but from other countries such as Canada are also following the same trend too.

It is simply about the demand and supply dynamics. There is a huge need for affordable housing. Thus investing in multifamily real estate makes sense.

Let’s get into some statistics here. Right now, there is a record number of renters in the market, literally. In the U.S., Over a million people are 70 years plus in age and 9.6 million are with a household income of less than $15,000 a year. They are typically renting. They have sold their primary residence and looking for affordable housing. Around 4.8 million people are receiving rental assistance too.

Home Ownership & Growth in Rental Values

The home ownership rate in the United States peaked in 2005, but it has fallen off a cliff since then. These people have to live somewhere so they may as well live in your multifamily properties, right? So here is the rent growth in the United States.

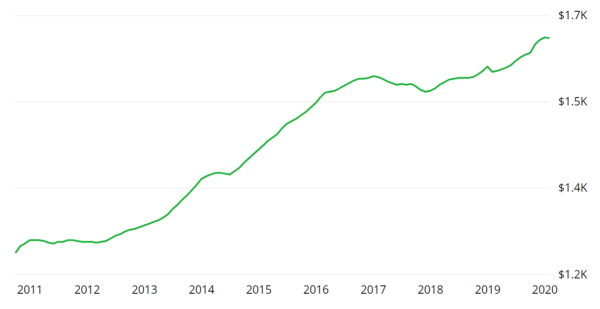

So now what has happened with growth in rental values in Florida, Austin, Sacramento, Portland, San Francisco, Denver. A consistent growth in the rental markets. That’s the observation from the past 10 years.

Growth in Rental Values in Florida (2011-20)

Source: Zillow

Home ownership has dropped by over 10%. Making this further interesting is that marriage rates have dropped by 25%. Since 1960 more single people equal more renters. Now affordable rents are needed. Over 50% of the people aged 18 to 23 still live at home. Isn’t that interesting graduates from 2015 have the most student debt in history.

Average of around 35,000 dollars are owed by student in student-debt and 2016 graduates are going to over 40,000 in student-debt, and it is horrible that you cannot get out of it.

But an estimated 12 million renter and homeowner households are now paying more than 50% of their annual income for housing.

So some pretty clear indicators are there in place and they are not going away indeed. Now there is a huge increase I demand for affordable housing. US needs 400,000 units a year just to keep up with the demand and this reflects on the market vibrancy. Household incomes have not kept pace with rental costs. At the same time, there is a huge mismatch between rental supply and demand.

Single-family Houses Versus Multifamily

When crisis hit hard, multifamily properties are doing just fine. If you are into this, you very well know this and you are very much poised for the stability and demand. This is going to be an incredible opportunity to buy properties, in fact. Of course there are going to be contractions but they are bearable.

If you are interested in real estate investing, do not get into single family! There are a lot of reasons for it.

Let us understand why. If you have a single-family house and it is vacant, you have 100% negative cashflow. But if you have a 10 unit building and somebody moves out from one unit, you are 10% vacant typically. You can still cover your mortgage payment smoothly.

If you buy right with just a thorough due diligence, you can get great multifamily properties that can provide superior cash flows. Don’t go for large deals initially as it takes a very long time and it takes a lot of work. It is much easier to achieve your goals with smaller multifamily properties in the beginning.

If you are looking for cash flow, for example, let’s say you want a $100,000 in annual income and let’s just use $200 cash flow per unit as a barometer, which is fairly common in a lot of areas in the country that so $2,400 per year cash flow per unit. You tracking out $200 per month 12 times i.e. 2400 cash flow per unit per year. You need 42 units to achieve your goal. So what’s more manageable – buying 40 units of multifamily, buying 21 duplexes or 42 single family houses?

Here is something else that’s huge when it comes to multifamily properties now,

I want to give you a little case in here- two to four units duplex, triplex four-plex that’s considered residential multifamily and the big advantage there.

Anybody that’s just getting started in real estate to buy as you, can get residential financing at very low-cost financing low interest rate low down payment fully amortized loan where you don’t have a balloon payment on residential multifamily, but 5 plus units is commercial and what’s exciting is commercial multifamily.

You control the value and the way you do is any increase in your income increases the value of the property. It is really net operating income (NOI), which is your gross income less your expenses. And if you improve that NOI by raising the income or lowering the expenses you enhance the value exponentially.

So houses are based on values of other properties which is subjective but 5+ apartments are based on the NOI, which is concrete and real and something you control through a lot of ways.

So here’s a fantastic example of the exponential impact on rental values.

Let’s say you have a 100-unit building and you raise the rents $20 a month. It is pretty reasonable rent, increase or decrease the expenses.

Maybe you build back the utilities or something as an example. If you have just increased the yearly NOI by $24,000, you do the math 20 times 12 times a hundred. It’s 24,000.

Add a 6% cap rate now. Cap rate is a multiple that is used to value multifamily properties. The lower the cap rate the higher the value and 6% cap is pretty standard in a 100-unit building right now unless it’s a real crap property. You just increase the value $400,000 with a $20 rent increase? Yeah, you got that – $20 rent increase raise the value $400,000 on a 100-unit building.

Ease of Financing & Managing the Property

Now here is another reason why multifamily is better than single-family. In multifamily, you can typically outsource property management. Managing single-family properties can be a pain and people stand you up. Then you talk about the logistics and maintenance, it’s logistically a real hassle. But if all your units are in one place, there are so many benefits to that.

In multifamily properties, there are economies of scale. A larger multifamily property allows you to hire a full time on-site management, but even in the smaller, you can have one of the residents to keep an eye on things show units things like that and it works very well.

Organizing finance for multifamily properties is much easier. If you buy 20 houses, you need to work with 20 different lenders and appraisers. But if you buy a 20-unit multifamily apartment building you do it much easier and with greater focus. There are a lot of other reasons why financing can be easier with multifamily. If your financial situation isn’t strong enough to buy a property by yourself, you can partner up with somebody and buy multifamily properties in partnership or as a syndication. But don’t buy all at one time and it’s the strength of the team, the experience and expertise of the team that allows you to buy right versus you personally buying single family homes, which are more expensive and exhaustive to manage.

Let’s talk about maintenance now. You wouldn’t think about this but when you have a maintenance guy that’s going out to a property, they do have to go there to see what it needs. They can’t really tell by a phone call from the tenant, they have to go and look. Then they have to go drive to the Home Depot or Lowe’s or whatever it needs. Then pick up the parts, go back, do the work and it takes a ton of time and that time costs money. Now imagine a bunch of different single-family houses and every one of them is different. They have different plumbing parts. They have different systems, furnace, lighting, fixtures, it’s all different. But if you buy like a 10-unit building typically whoever built that will have everything the same so you can stockpile parts. They don’t have to go anywhere. It’s much less expensive and efficient indeed.

Multifamily properties are designed for easy management, whether 2 or 20 units, much simpler to manage. It’s designed for easier leasing. It also means less driving, less maintenance time, less costs.

This is all about improving the bottom line for you because that’s why you are doing this – for the cash flow, for the monthly revenue.

Easy to sell

Now, let’s say you have got 50 single-family houses and you are trying to sell them out. It is hard because only a handful of people are interested in buying. So you either find that one of those people or you have to sell them one at a time. It takes a long time.

Compare this with a 50-unit building. In this case 50 single-family houses versus the 50-unit multifamily building, it is a huge difference.

Tax benefits

Let’s talk about another reason that goes in the favor of multifamily properties. One of the biggest reasons is tax benefits – it is exponential! The wealthiest people in the world own real estate because it mitigates all their taxes. This is huge cost segregation. This allows you to accelerate your depreciation.

In overall, multifamily real estate investing is a win-win strategy if you get the fundamentals right.

Want to know more about multifamily investing? Sign-up for free multifamily education with the MIH Mastermind Group: https://bit.ly/2Wsb9xR